Helping Retirees Offset Inflation

Inflation will continue to rise well into 2023 and beyond without significant course corrections. Bankrate’s Third-Quarter Economic Indicator poll projects inflation will be more significant than previous expectations over the coming twelve to eighteen months. Even in the best economic outcomes for 2023, maximizing allowable benefits to offset inflationary pressures is a smart strategy.

Rising prices may create a gap between your income plans and real bill-paying requirements. Withdrawing higher amounts from retirement savings can affect your retirement plan’s long-term sustainability. When planning bill pay strategies, remember prices typically don’t rise evenly across all sectors. Medical care costs have risen significantly in recent decades yet rose slower than overall inflation at 4 percent in the past year. However, fuel, food, and utility costs are up sharply for the same period.

Targeting a level of growth that exceeds an already accounted-for level of inflation is part of a good retirement strategy. Still, it can’t account for short-term excessive inflationary pressures. Taking distributions in the short term must remain in balance with maintaining long-term investment growth to preserve retirement income. There are steps you can take to achieve this balance.

Budget Review and Adjustment to Short-Term Spending

Finding ways to cut costs is the easiest way to avoid taking increased distributions or asset spending. Conserve energy use in your home and group errands that require car transportation to like locations to reduce gasoline use. In inflationary times, trimming discretionary expenses like dining out, vacations, or home renovation can help your budget. If you are already tightening your budget with these techniques, you may consider picking up some part-time work to close the income gap without upending your retirement planning.

Ensure Proper Wealth Allocations

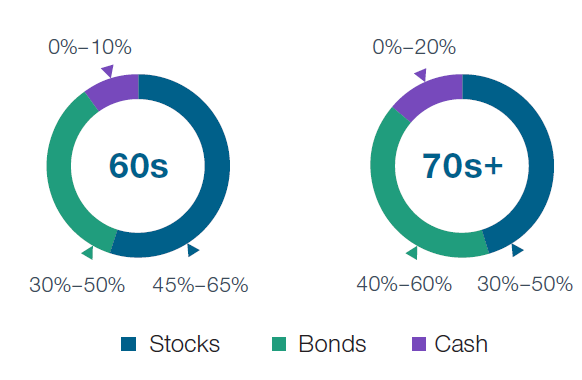

Historically, stocks averaged annual returns to stay ahead of inflation. A balance of cash, bonds, ETFs, value stocks with dividends, and market sector investment rotations help maintain financial stability in uncertain times.

The S&P 500 is the lowest in a decade, decreasing over 17 percent. However, the Great Recession of 2007-9 saw the index down 38.4%. Historic market trends indicate that bullish investors will return to the stock market by mid-2023. Not assessing historical trends and re-adjusting your portfolio can make you miss a big chunk of the recovery and potential gains.

This graph of model asset allocations from T. Rowe Price’s investment strategy for retirees can help guide retirement investment strategy by general percentages.

Maintain an Appropriate Stash of Cash

Managing short-term income with long-term growth makes a regular review of your plans necessary. Investing is never a set-and-forget process since personal needs change, corporations’ profitability fluctuates, and market realities change according to economic conditions. Particularly in the equities market, investing trends cycle by market sector. Even though inflation will reduce the spending power of cash on hand, cash availability is crucial for those unavoidable and unforeseen expenses.

Generally, a healthy cash position can cover one to two years of expenses in early retirement and keep you from withdrawing from your longer-term investments. This is particularly true when periods of inflation coincide with the declining market value of your investments.

Maximize Your Social Security Benefits

Work longer to obtain the maximum Social Security will pay based on your best thirty-five years of income. Earning more money to pay into the system will yield a larger payout (up to a point) when you claim your benefits. Delay your benefits up to age seventy, and you will receive a higher monthly payment.

During inflationary times, Social Security benefits automatically adjust to ensure purchasing power adjusts for inflation. If you have not yet claimed your benefits, remember the COLA maintains your benefits to adjust for inflation. When you are ready to claim your benefits, there are options depending on if you are married or divorced. Spouses and ex-spouses must carefully consider scenarios, particularly regarding survivor’s benefits, when one spouse predeceases the other. Divorced from a ten-year marriage for a minimum of two years and still single? You may be entitled to file for benefits based on an ex-spouse’s earnings. Bankrate reviews scenarios for Social Security spousal benefits.

Consider Inflation as You Update Broader Financial Plans

Effective retirement strategies rely on accurate estimates of household spending and adaptation to new norms. This number will change yearly, particularly in an inflationary environment. Your retirement strategy will require adjustments depending on personal circumstances, market conditions affecting your investments, and prevailing inflation rates.

As retirement planning links closely to your overall estate and legacy planning, it is crucial to coordinate the two. An estate planning attorney or an elder law attorney can help to ensure any trusts you create will have sustainable funding and make other recommendations about retirement plans and how they affect your estate planning goals.

Working with a financial professional or using financial planning tools while creating your estate plan can provide insights. As inflation continues to present economic challenges for household expenditures, it’s important to review your existing retirement plans regularly, as you do for your estate plan. Ultimately, an appropriate allocation in stocks that receive a regular review in combination with managed spending and flexibility provide the most important tools retirees

Contact our Ruston, LA office by calling us at (318) 255-1760 to speak to one of our experienced estate attorneys. We can work with your financial advisor to develop the best financial solutions for retirement.