What is the Role of an Elder Law Attorney for Your Legal Matters?

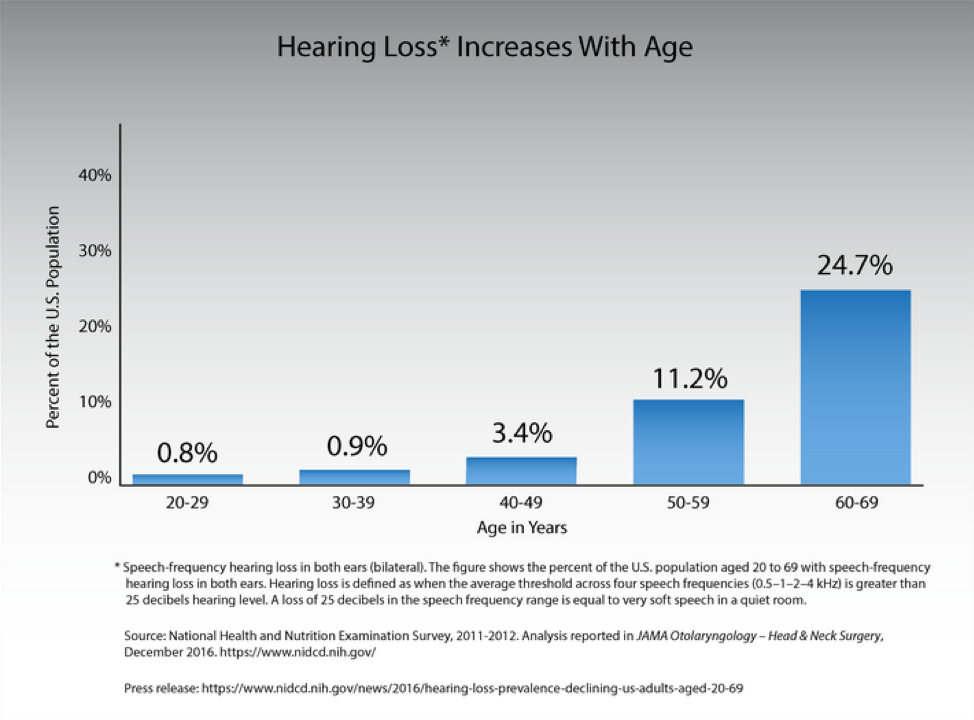

The senior citizen population of the United States is increasing rapidly as the baby boomer generation ages, and the influx of international migration continues. Although the US average life expectancy has seen a slight three-year decline, many Americans, men, and women live well into their 80s, 90s, and beyond. An elder law attorney works with seniors, taking a holistic approach to the legal issues people commonly face as they age. These include matters of housing, physical and financial health, estate planning, and more. There are as many issues as there are seniors, as life circumstances are different for everyone. An attorney who specializes in the host of the problems senior citizens face can be a wise investment.

Whether you have a lucrative business and many assets, or a small home with a modest bank account, estate planning can be overwhelming. However, having your affairs in order is a final gift to your family. An estate plan is much more than creating your will though it is generally the first step. There are multiple types of wills, and while most people think of their last will and testament, there are also living wills, joint wills, pour-over wills that work in conjunction with trusts, and more. The type of will(s) you need to best control what happens to you and your assets throughout your life, and your death, are best explained by an elder law attorney. An elder law attorney specializing in estate planning helps you navigate wills, trusts, guardianships, advance medical directives, and the financial management of life insurance policies, annuities, IRAs, and 401ks. All of these can have tax implications for managing and settling your estate.

Government programs on federal and state levels may be available to seniors. Individual qualifications and the application processes can be complicated and confusing, especially when enrolling for the first time. An elder law attorney can help you understand Medicare Part A (hospital, skilled nursing, some home health, and hospice), Part B (medical insurance covering certain services by doctors, preventative services, medical supplies, and outpatient care). Medicare Part C (Medicare Advantage Plans, a private company insurance plan you purchase that dovetails with Medicare) and Part D (covering prescription drugs). If you are a veteran, programs are available through the Veteran’s Administration and can provide you with further and more specialized assistance because of your military service. Veteran program qualifications can be highly complex, so look for an elder law attorney who is accredited by the Veterans Administration.

Medicaid provides health care benefits for low resource and low-income adults, pregnant women, elderly adults, children, and people with disabilities. If you qualify, you may receive both Medicare and Medicaid benefits. Medicaid qualifiers have their healthcare premiums and out of pocket medical expenses covered through the program. Medicaid also includes custodial care and addresses long-term care expenses if you begin living in a nursing home. An elder law attorney understands how Medicare and Medicaid can work to your best advantage.

Social Security benefit amounts change depending on the age range you choose to receive your benefit. You can currently apply and qualify for your benefits at 61 and nine months of age; however, the full retirement age for social security is 67, and cashing in early has long-term consequences for your payout. An elder law attorney can help you determine the best age to receive your social security benefits based on your health and financial situation. Suppose you also receive disability benefits before full retirement age or become disabled at that age. In that case, an elder law attorney can ensure you receive the proper benefits based on your condition.

Long-term care is known to be an expensive proposition whether you are trying to afford long-term care insurance upfront or pay for it out of pocket if you require it in the future. Not addressing the issue of long-term care is a big gamble to your financial well being. Morningstar reports that 52 percent of Americans turning age 65 will need some long-term care services in their lifetime. An elder law attorney can help you understand policy premiums and how they can increase if you purchase long-term care insurance. They can also guide you through Medicaid planning or estate planning that can help you qualify for the best financial arrangements for long-term care. Sometimes, it is beneficial to spend down your estate to be eligible for Medicaid, and your elder law attorney will know what is required by law to do it properly.

Other issues, such as employment discrimination, elder abuse, and elder fraud, even grandparent visitation rights, fall under an elder law attorney’s scope. An attorney who practices elder law has a more comprehensive list of capabilities to help you through your senior years than those attorneys without expertise in this area.

We focus on elder law. We would be honored to speak to you about how we can help you come up with a comprehensive legal plan covering many of the topics above so you can enjoy your senior years without unnecessary worry. We look forward to hearing from you. Please contact our Ruston, LA office by calling us at (318) 255-1760 or schedule an appointment to discuss how we can help with your elder law needs.