Essential Legal Documents

Essential legal documents for those who wish to protect their families and themselves should develop an estate plan. Making sound decisions regarding finances and healthcare can become challenging as you age due to diminished mental capacity or declining health. Putting these five must-have essential legal documents in place before life becomes too difficult to handle is crucial for your protection and wishes. It is not legally permissible for you to create these documents if you are too far into ill health, and guardianship will become necessary for decision-making on your behalf. Retaining a trusted elder law attorney is the first step to setting these legal guidelines to carry out your wishes.

Will

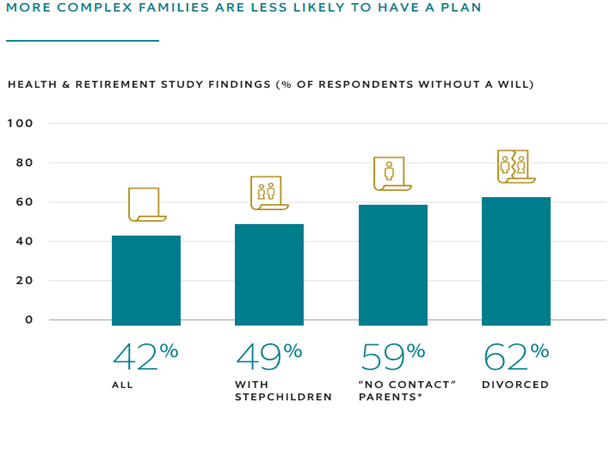

The will is a legal document that outlines who receives your assets after death. A valid will is critical for adults to possess regardless of age. It is especially true if you have dependent children since your will identifies guardians for them. Without a will, the courts decide who is responsible for raising your children and what happens to your assets. Each state has statutes that prescribe the formalities to observe in making a valid will. Writing, signature, witnesses, acknowledgment, and attestation may vary slightly depending on where you live.

Revocable Trust

This type of trust allows the settlor to amend, add assets to, or terminate the trust for as long as they like or until they can’t manage the trust competently. The grantor names a trustee who will eventually make daily decisions regarding certain assets on behalf of the trust and transfers these assets to beneficiaries upon the settlor’s death. Assets in the trust generally pass outside of a will and outside of probate. A revocable trust can make a potential guardianship process unnecessary.

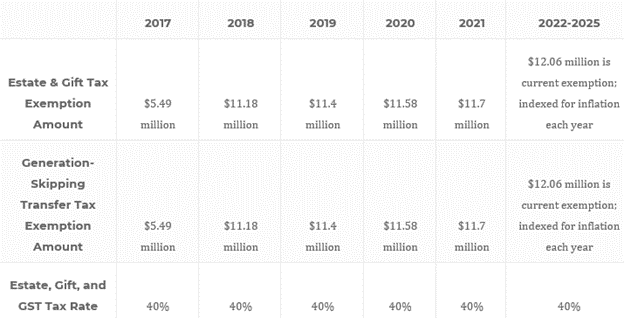

A revocable trust is an estate planning tool used to reduce probate fees and delays in asset distribution and protect assets from becoming a matter of public record. You don’t need to have significant assets to benefit from this trust. You can place your home, checking account, life insurance policies, jewelry, or other valuable assets into your trust. Your estate planning lawyer can design your revocable trust to reduce federal estate taxes. A revocable living trust is one of the most important documents for nearly anyone to have in their estate plan.

Medical Directives or Advanced Directives

This document, also known as an Advanced Directive, is a comprehensive and specific document outlining the wishes of a person’s healthcare choices in anticipation of incapacitation, illness, or end-of-life care. Some individuals want medically heroic measures to remain alive. Others might opt for a peaceful passing and less invasive care. For example, if you want artificial support to breathe or eat via a ventilator or feeding tube, that is an individual choice. A medical directive allows you to state these types of choices.

Most often, individuals prefer to weigh the benefits of medical intervention as it affects their quality of life. One can be alive yet hardly “living.” A medical directive provides clarity and guidance in decision-making for medical teams and family members regarding your ill health, incapacitation, and end-of-life choices for care.

Durable Healthcare Power of Attorney

This document permits the legal transfer of authority to make medical decisions on your behalf. The designee, known as the agent, can determine what medical procedures are allowable on the principal’s behalf in the event of incapacitation. This document differs from a medical directive that only explains your health care wishes. A healthcare power of attorney assigns decision-making power to act on your behalf when you are no longer capable.

The combination of a medical directive and healthcare power of attorney assures you will receive the care you desire. The medical directive serves as the blueprint for your health care decision preferences. The healthcare power of attorney gives the legal authority to effect decisions based on this blueprint..

Power of Attorney for Finances

Depending on how the document is written, this designated agent can make many financial decisions for the principal. They may include overall financial affairs, bill pay, property sale, bank safe deposit boxes, contract for services, property rental, tax audits, and more. There are four basic types of power of attorney:

- Limited– This power of attorney type is narrow or limited in scope. An agent may act on your behalf for a specific purpose. This can include signing a property deed in your name while you are out of town. Usually, a date will terminate the agent’s power, or it is contingent upon completing the outlined task.

- General– This is a comprehensive power giving your attorney-in-fact all rights and authority you have. A general power of attorney may sign documents, pay your bills, and conduct financial transactions on your behalf. People with complex business affairs and hectic travel schedules often use a power of attorney for conducting financial matters. This agent’s legal designation and power will end upon your death or incapacitation unless you rescind it before that time.

- Durable – This power of attorney type can be limited in scope or general but will remain in effect after your incapacitation. Absent a durable power of attorney; if you become incapacitated, there is no legal representation to act on your behalf unless a court appoints a guardian or conservator. A durable power of attorney will remain in effect, managing your financial affairs until your death or choice to rescind it while mentally sound. In Louisiana, all powers of attorney are automatically durable, unless the document says otherwise.

- Springing – Much like a durable power of attorney, a springing power of attorney can act as your attorney-in-fact. However, this only becomes effective when you become incapacitated. If you choose to employ this power of attorney type, it is critical to determine the standard that identifies your incapacity. This identifying trigger that enables power of attorney must be clearly written in the document.

Essential Legal Documents

Before making a selection, it is important to understand the different types of power of attorney. Your attorney will be most effective for your situation. Your attorney-in-fact (agent) will control your finances, so the agent you select must be someone you trust implicitly. If you do not have a viable candidate for a financial power of attorney, you may consider using your attorney or a licensed fiduciary company.

Speak with your lawyer today to implement these five critical essential legal documents in your estate plan. An unexpected adverse health event can happen anytime and at any age. These essential legal documents will protect your wishes, well-being, and assets at a time when you and your family are at the most vulnerable.

For assistance, please contact our Ruston, LA office by calling us at (318) 255-1760.